Cyber risks: an insurance offer in development

This article was automatically translated from HIBAPRESS, the Arabic version:

Hibapress

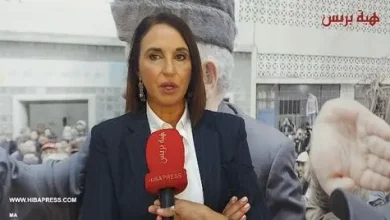

The Minister of Economy and Finance, Nadia Fettah, announced on Wednesday on the occasion of the Casablanca Insurance meeting, that an insurance offer against Cyber risks is under development.

“In 2022, 82% of major global insurance companies were the target of ransomware. Morocco reacted vigorously, by adopting law 20-05 on cybersecurity, and by implementing a national directive to strengthen the security of information systems. It is a question of creating a confidence environment, where data becomes a protected asset, and not a vulnerability. The development of an insurance offer against cyber risks is also underway, “said Fettah during this 11th edition which is held until April 17.

To this end, it insisted on the importance of anticipating the needs of businesses, institutions and citizens, faced with a threat that continues to grow.

Accenting the theme held this year for this event, “New technologies and AI: what opportunities for insurance? “, The Minister said that artificial intelligence (AI) is a” tremendous opportunity “for the sector because it allows the automation of subscription, detection of fraud, personalization of offers, or the predictive analysis of risks.

And to continue: “In the United States, an automotive insurance company has reduced manual tasks linked to claims by 70% thanks to an IA bot. What make more than one portfolio manager dream. But the AI goes further. In Africa, it makes it possible for access to insurance in the most remote areas, through mobile and digital solutions ”.

In this sense, Ms. Fettah cited Kenya as an inspiring example, with health insurance via mobile, which changed the lives of millions of citizens, claiming that Morocco, for its part, is also advancing in this way, with a strategy of financial inclusion that targets young people, women and rural populations.

The Minister also noted that the role of insurance is central, in particular in a context where natural disasters are more and more frequent (floods, drought, earthquake, …).

According to her, “emerging technologies, in particular satellites, drones, IoT and AI, allow today to predict, monitor and prize the risks with unprecedented precision”.

They also allow the development of parametric insurance, which automatically triggers compensation as soon as a predefined threshold is reached, added Ms. Fettah, noting that this type of insurance, based on objective data, can make the difference for farmers, craftsmen and small and medium -sized enterprises (SMEs) who need a quick response to survive a shock.

However, if these innovations have hope, they are not without challenges, noted the minister. “The integration of these technologies presupposes significant investments, a skills of the teams, and an evolution of the regulatory framework. It also requires guarantee data security. Because with the proliferation of sensors and platforms, the question of data governance becomes crucial, ”she detailed.

At the same time, Ms. Fettah stressed the need to preserve the balance between personalization and pooling. “AI allows you to finely target profiles, but be careful not to fragment the risk to the point of excluding the most vulnerable. Inclusion must remain at the heart of our model ”. The minister said that tomorrow’s insurance will be more agile, more digital, but it should also be more equitable, more resilient and more united.

In addition, Ms. Fettah praised the strong African presence at this edition of the Casablanca Insurance meeting, and congratulated Ghana, honored this year. “Ghana embodies a dynamic of innovation, technological agility and regional integration, in line with the vision that we share for a continent turned towards the future”.

Organized by the Moroccan Insurance Federation (FMA), the Casablanca Insurance meeting, which is placed under the high patronage of King Mohammed VI, constitutes an opportunity to discuss the growing role of AI in insurance which is a sector in constant evolution.

The FMA is an association that brings together the 25 insurance and reinsurance companies operating in Morocco. Its main role is to undertake any action deemed appropriate for its members and work in the interest of the insurance sector.