BAM: Evolution of the money supply in May 2024

HIBAPRESS-RABAT-BAM

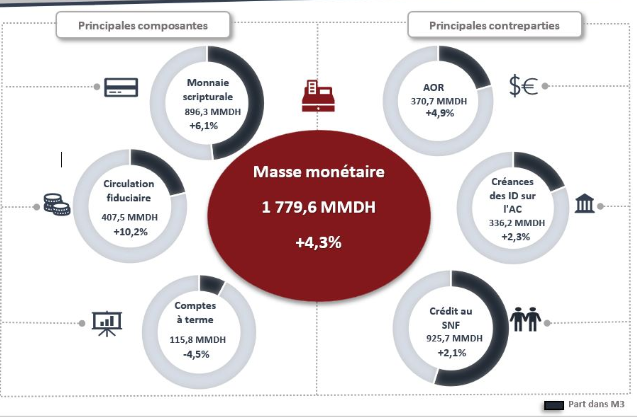

In May 2024, the money supply, estimated at 1,779.6 billion dirhams, increased year-on-year by 4.3%, the same rate of change as the previous month. This development mainly reflects the acceleration of the growth of fiat money to 10.2% after 8.5%, the attenuation of the decline in term accounts from 6.8% to 4.5%, the slowdown from 7.9% to 6.9% in the growth of sight deposits with banks and the accentuation of the decline in holdings of economic agents in monetary mutual fund securities from 12.5% to 18.5%.

On the other hand, the stagnation in the growth of the money supply is the combined result of the slowdown from 2.7% to 2.1% in the growth of bank credit to the non-financial sector and the increase in net claims on the Central Administration of 2.3% after a decrease of 0.4%, as well as the increase in AOR of 4.9% after having stabilized at their level of April 2023.

The slowdown in the growth of loans to the non-financial sector reflects the slowdown in the growth of loans allocated to the private sector from 1.1% to 0.5%, covering a decrease of 1.2% after an increase of 0.9% in loans allocated to private non-financial companies and an increase of 0.9% after the increase of 0.5% in credits to households. Similarly, loans to the public sector saw their pace slow down from 17.7% to 17.4%, with a slowdown in the growth of loans to public non-financial companies from 24.3% to 23.8%.

By economic object, the evolution of banking support to the non-financial sector covers a decrease in the growth of cash facilities of 1.1% after an increase of 0.1% and an increase in equipment loans of 7.5% after 5%, real estate loans of 1.3% after 0.7% and consumer loans of 0.9% after a decline of 0.1%. Regarding non-performing loans (CES), their growth slowed to 4% after 5.1% in April 2024 and their ratio to credit stagnated at 8.8%.